|

Our Primary Strategic Investments are in Mount Gibson Iron

Limited (“Mount Gibson”) (ASX: MGX), Tanami Gold NL (“Tanami

Gold”) (ASX: TAM), Metals X Limited (“Metals X”) (ASX: MLX),

Dragon Mining Limited (“Dragon Mining”) (HKEX: 1712) and Prodigy

Gold NL (“Prodigy Gold”) (ASX: PRX), where APAC owns 38.4%,

46.3%, 23.3%, 29.7% and 29.6% respectively. They are listed and

operating in Australia.

The combined net attributable profit shared from Mount Gibson,

Tanami Gold, Metals X, Dragon Mining and Prodigy Gold which are

accounted for as the Group’s associates for FY2025 was

HK$38,097,000 (FY2024: HK$38,101,000).

During the year, APAC’s shareholding in Prodigy Gold fell from

44.3% as at 30 June 2024 to 29.6% as at 30 June 2025 as APAC

chose not to participate in Prodigy Gold’s equity raising.

Prodigy Gold is deconsolidated from APAC and accounted as an

associate from 30 October 2024. Meanwhile, APAC’s ownership of

Mount Gibson and Metals X have increased to 38.4% (from 37.3%)

and 23.3% (from 22.8%) respectively as at 30 June 2025, due to

cancellation of shares by Mount Gibson and Metals X.

Mount Gibson

Mount Gibson is an Australian producer of direct shipping grade

iron ore products. Mount Gibson owns the Koolan Island mine off

the Kimberley coast in the remote north-west of Western

Australia.

Ore sales at the Koolan Island Restart Project started in April

2019 and achieved commercial production in the June quarter of

2019. The restart project had 21 million tonnes of 65.5% Fe

reserves. Mount Gibson has completed a planned waste mining

phase, enabling increased production from 2023 onwards.

Mount Gibson reported a net loss after tax of A$82.2 million for

FY2025 from sales of 2.6 million tonnes of iron ore. Production

and grades were constrained in September quarter while a

necessary reconfiguration was undertaken and a new switchback

was constructed in the centre of the pit, which pushed up

operating costs. In addition, A$90.4 million impairment expense

has been recorded in the year as a result of weak iron ore

prices. Yet, operational improvement was seen since December

quarter of 2024 after the reconfiguration. Production was also

slightly impacted by remedial ground support activities on the

central footwall and weather-related interruptions in the second

half of FY2025. Operating costs and production slightly missed

the Mount Gibson’s FY2025 guidance given the temporary overhangs

during the year.

Sales guidance for the year ending 30 June 2026 (“FY2026”) is

3.0 million to 3.2 million tonnes. Mount Gibson’s cash and

investment reserves was A$484.6 million at the end of FY2025.

The Platts IODEX 62% CFR China index traded in a relatively

narrow range in FY2025, with lows near US$90 per dry metric

tonne (“dmt”) in September 2024 and closing at near US$94 per

dmt. In mid-August 2025, the price is around US$100 per dmt with

an improvement driven by speculation on Chinese production cuts

and hopes for large scale China infrastructure projects. Iron

ore prices are expected to fluctuate with sentiment related to

China’s economy.

Tanami Gold

APAC owns 46.3% of Tanami Gold at 30 June 2025. Tanami Gold’s

principal business activity is gold exploration. It holds 50% of

the Central Tanami Project and has a cash balance of A$19

million. In May 2021, Tanami Gold entered into a binding

agreement with Northern Star Resources Limited (“Northern Star”)

(ASX: NST) to establish a new 50-50 Joint Venture covering the

Central Tanami Project (“CTPJV”). On 16 July 2025, Mount Gibson

has announced reaching agreement to acquire 50% of the CTPJV

plus adjacent wholly owned exploration tenements from Northern

Star.

Metals X

APAC has increased its shareholding in Metals X from 22.8% as at

30 June 2024 to 23.3% as at 30 June 2025. Metals X is focused on

implementing its life of mine plan at Renison mine, including

the development of the high-grade Area 5 deposit. In the twelve

months ended June 2025, the Renison mine produced 5,692 tonnes

of tin (net 50% basis), at all-in sustaining costs of A$29,459

per tonne against a tin price of A$48,553 per tonne for imputed

EBITDA of A$274 million.

Like most base metals, tin prices slumped after demand concerns

after the announcement of reciprocal tariffs by the United

States (“US”) in April 2025 despite peaking in early April 2025

due to supply disruption in the Democratic Republic of the

Congo. Tin prices gradually recovered and remained one of the

strongest base metals due to solid supply-demand fundamentals.

In mid-August 2025, the tin price is circa US$33,750 per tonne.

We remain comfortable with the outlook for tin due to the lack

of significant supply growth, growing demand for tin from the

electrification trend, and growth from semiconductors and energy

storage industries.

Dragon Mining

APAC owns approximately 29.7% of Dragon Mining as at 30 June

2025.

The principal activity of Dragon Mining is gold exploration,

mining, and processing in the Nordic region. Dragon Mining

operates gold mines and processing facilities in Finland and

Sweden. In Finland, the Vammala Production Centre consists of a

conventional 300,000 tonnes per annum crushing, milling and

flotation plant, the Jokisivu Gold mine, the Orivesi Gold mine

which ceased production in June 2019, and the Kaapelinkulma Gold

mine which ceased production in April 2021, and the Uunimäki

Gold project. Annual production from Dragon Mining is in the

range of 20,000 to 30,000 ounces of gold in concentrate

depending on the grade of ore and gold concentrate feed. In

Sweden, the operation is known as the Svartliden Production

Centre, consisting of a 300,000 tonnes per annum carbon-in-leach

processing plant together with the closed Svartliden Gold mine

(mining completed in 2013), and the Fäboliden Gold mine where a

campaign of test-mining was completed in September 2020.

On

1 April 2025, Allied Properties Resources Limited (“APRL”), a

wholly-owned subsidiary of APAC announced a preconditional

voluntary cash offer of HK$2.2 per share for all issued shares

of Dragon Mining not owned by APRL and its concert parties. On

19 May 2025, Wah Cheong Development (B.V.I.) Limited (“Wah

Cheong”), an indirect wholly-owned subsidiary of Allied Group

Limited (a substantial shareholder of APAC), announced a

conditional voluntary cash offer of HK$2.60 per share for all

issued shares of Dragon Mining not owned by Wah Cheong and its

concert parties. On 2 June 2025, APRL’s offer was withdrawn.

Prodigy Gold

APAC owns approximately 29.6% of Prodigy Gold at 30 June 2025.

Prodigy Gold is a gold exploration company listed on the ASX. It

holds a large footprint of exploration tenements in the Tanami

region in the Northern Territory, Australia, and a JORC (Joint

Ore Resources Committee) resource of 1.03 million ounces across

its Hyperion, Tregony, Buccaneer and Old Pirate projects. Some

of its tenements are held in joint venture with partners such as

Newmont Corporation and IGO Limited. Prodigy Gold reported a net

loss after tax of A$3.5 million for FY2025. At the end of June

2025, Prodigy Gold has a cash balance of A$1.2 million. The

focus of Prodigy Gold for 2025 will be exploration on the

Northern Tanami project area and continue with its strategy to

divest non-core assets.

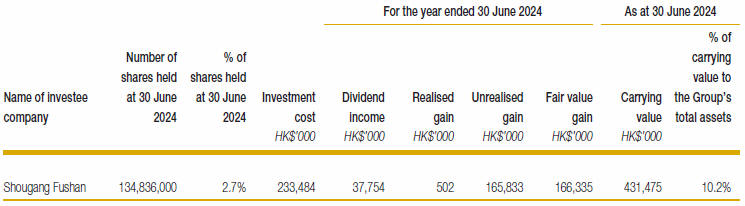

Financial Assets at Fair Value

through Profit or Loss

Financial assets at fair value through profit or loss comprise

mainly the Group’s Resource Investment. As at 30 June 2025, APAC

had significant investment representing 5% or more of the

Group’s total assets in Shougang Fushan Resources Group Limited

(“Shougang Fushan”) (HKEX: 639).

Significant Investment

Our investment in Shougang Fushan generated a fair value loss of

HK$44,248,000 during the year with a carrying value of

HK$406,577,000 as at 30 June 2025.

Shougang Fushan is a coking coal producer listed on The Stock

Exchange of Hong Kong Limited. Its principal businesses are

coking coal mining and the production and sales of coking coal

products in China. It has three mines located in China with

reserves of 54 million tonnes of raw coking coal at 31 December

2024 and during six months ended 30 June 2025 Shougang Fushan

produced 2.6 million tonnes of raw coking coal and sold 1.6

million tonnes of clean coking coal.

The market capitalisation of Shougang Fushan at the end of

August 2025 is around HK$14 billion. During the six months ended

30 June 2025, Shougang Fushan generated revenue of HK$2,101

million and a profit of HK$481 million and had cash and time

deposits of HK$9.4 billion at 30 June 2025.

Resource Investment

The investments in this division comprise mostly minor and

liquid holdings in various natural resource companies listed on

major stock exchanges, including Australia, Canada, Hong Kong,

the United Kingdom and the US. Our investments focus on select

commodities within several commodity segments: energy, bulk

commodities, base metals and precious metals.

Resource Investment posted a fair value gain of HK$338,149,000

in FY2025 (FY2024: HK$364,260,000), which after accounting for

segment-related dividends and other investment income and

expenses, resulted in a segment profit of HK$342,743,000

(FY2024: HK$403,722,000).

Our Resource Investment division includes, among other investing

strategies, the two resource portfolios announced in August

2016, with an additional natural resource-focused strategy

subsequently established and focused on large caps and

specialist opportunities. The aim of the portfolios is to

produce a positive return using the Company’s funds as well as

to create a track record to attract potential third-party

investments in the future. These various portfolios are managed

under the Resource Investment segment of the Company, which is

separate from the Company’s large strategic stakes. Our

portfolios have a global long-only mandate (cannot short stocks)

and strict parameters on market capitalisation, liquidity,

development stage (exploration through to production) and

jurisdiction to manage risk.

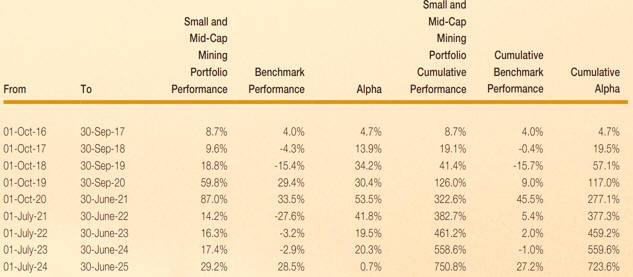

Small and Mid-Cap Mining Portfolio

This portfolio is focused on investments in small and mid-cap

companies involved in the exploration, development and

production of battery metals, base metals, precious metals,

uranium, bulks and other hard rock commodities. Managed by the

same portfolio manager since its inception on 1 October 2016,

the Small and Mid-Cap Mining Portfolio has delivered a return of

751% in the 8.75 years to 30 June 2025. This represents a

significant outperformance of 724% against its benchmark

(currency adjusted equal weighting of the ASX 200 Smallcap

Resources, FTSE AIM All Share Basic Resources and TSX Venture

Composite), which returned 27% over the same period.

A

full breakdown of the Small and Midcap Mining Portfolio’s annual

performance against its benchmark is presented in the table

below.

The strategy delivered a period of strong positive performance

for the year ended 30 June 2025, driven by a broad recovery in

commodity markets during the first half of calendar year 2025.

This resurgence was underpinned by easing monetary policies in

major economies, which stimulated industrial activity and

capital investment, in turn boosting demand for raw materials.

The portfolio benefited from this improved macroeconomic

backdrop, with a notable reversal of the headwinds experienced

in late 2024.

A

key driver of the portfolio’s outperformance was its significant

outsized positioning in the gold sector with a circa 40-70%

weighting since early 2024. This tactical decision was based on

a positive outlook for gold – given elevated central bank

buying, elevated geopolitical uncertainty, rising investor

demand and the more recent dedollarisation trend – and has

proven highly effective, especially as investors increasingly

recognised significantly improved margins and cash flow

generation by gold mining companies. Top contributors to

portfolio returns were predominantly gold-focused companies,

including Kingsgate Consolidated, Heliostar Metals, Discovery

Metals, Resolute Mining, Meeka Metals, Orezone Gold, Thesis Gold

and Greatland Resources.

Conversely, a number of holdings acted as a drag on portfolio

returns. The top detractors were generally dragged down by weak

underlying commodity prices and included Coronado Global

Resources (metallurgical coal), Q2 Metals (lithium), Meteoric

Resources and Viridis Metals and Minerals (rare earths). Other

poor performers were negatively impacted by weak operational

results and downgraded guidance, like Galiano Gold and Ora

Banda. However, looking forward to the financial year ending 30

June 2026, a number of these past underperformers are now

looking more positive, with share prices turning higher, and

this has underpinned a positive start to the new financial year

for the Small and Mid-Cap Mining Portfolio.

Energy Portfolio

This portfolio is primarily focused on the oil, gas, power and

renewables sectors. At the end of 2019, the mandate for this

portfolio was expanded to include investments in renewables, and

with a broader sector of investments, from February 2020 (before

the full impact of the Covid-19 Pandemic) to August 2025, the

Energy Portfolio has generated a return on investment of 140%.

The investment choices in the Energy Portfolio are selected

through a combination of fundamental bottom up valuation and

analysis of the prospects for different sectors. During the

early days of the COVID-19 pandemic, the investments were

focused in companies in the green energy sector given that the

low interest rate environment was supportive of stocks with

significant growth potential. Recently equities across almost

all sectors were jostled by concerns related to “Liberation Day”

in early April 2025 when markets were shocked by the large US

tariffs proposed. In the year ending 30 June 2025, we focused on

companies that support base load power (predominantly natural

gas in select countries and uranium) given growing demand for

power in the US and a strong equity market focus on names

exposed to artificial intelligent (“AI”) power demand. At the

same time, we reduced oil exposure, given concerns of slow US

growth in the event of new tariffs being implemented, although

we subsequently saw lots of volatility related to military

attacks on Iran. We have had essentially no investments in the

renewables sub-sector in FY2025 given our concerns on weak

sentiment in the event that significant Inflation Reduction Act

policies were reversed by President Trump. We remain cautious on

the outlook for oil given OPEC+ has made significant additions

to the global market by unwinding production cuts. The energy

transition continues, and we are becoming cautiously optimistic

given the reduction in policy uncertainty in August and after a

significant sell off in the last twelve months.

Precious Metals

The Precious Metals segment (majority gold exposure) generated a

net fair value gain of HK$510,007,000 in FY2025. As at 30 June

2025, the carrying value of the Precious Metals segment was

HK$1,045,084,000 (As at 30 June 2024: HK$686,052,000). Our

largest gold investment in the Resource Investment division is

in Northern Star (ASX: NST) which generated a fair value gain of

HK$34,311,000 with a carrying value as at 30 June 2025 of

HK$95,186,000. We also own Kingsgate Consolidated Ltd (ASX: KCN)

which generated a fair value gain of HK$28,450,000 with a

carrying value as at 30 June 2025 of HK$51,026,000. Northern

Star is the largest gold company in Australia and owns

high-grade underground mines in Western Australia and Alaska. It

operates three gold production centres, namely Kalgoorlie and

Yandal in Western Australia and Pogo in Alaska, and the Hemi

Development Project, located in the Pilbara region of Western

Australia. In FY2025, its production was 1,618,000 ounces of

gold, and it generated a net mine cash flow of A$1,189 million.

In FY2026, its production target is 1,700,000 – 1,850,000

ounces.

The gold price had a strong rally in FY2025 from approximately

US$2,300 per ounce and reached a high of US$3,500 per ounce

before closing around US$3,300 per ounce. The strength in gold

prices has been a surprise given the high interest rate in the

US, and there is speculation that it has been driven by central

bank purchases, safe haven demand amid worries on geopolitical

tensions and expectations that global monetary policies would

loosen.

Bulk Commodities

The Bulk Commodities segment generated a

fair value loss of HK$96,039,000 in FY2025. As at 30 June 2025,

the carrying value was HK$492,600,000 (As at 30 June 2024:

HK$584,717,000). Our largest investment in this segment during

FY2025 is in Shougang Fushan (HKEX: 639), which generated a fair

value loss of HK$44,248,000 and had a carrying value as at 30

June 2025 of HK$406,577,000.

Base Metals

The Base Metals segment (a mix of copper,

nickel, zinc, aluminium, tin and cobalt companies) delivered a

fair value loss of HK$2,286,000 in FY2025. During the year, base

metal prices were mixed, with copper prices up 2.8%, nickel

prices down 11.9%, and zinc prices down 4.8%. The Base Metals

segment includes our investment in Lundin Mining Corp (TSE: LUN)

which had a carrying value as at 30 June 2025 of HK$28,763,000.

Energy

The Energy segment (mix of oil and gas,

uranium and renewables) had a fair value loss of HK$26,350,000

and a carrying value of HK$163,539,000 in FY2025 (As at 30 June

2024: HK$232,734,000). Our significant energy investments

include Paladin Energy Limited (ASX: PDN), which generated a

fair value loss of HK$1,398,000 and had a carrying value as at

30 June 2025 of HK$52,797,000.

Others

We also have a fair value loss of

HK$47,054,000 from the remaining commodity (diamonds, manganese,

rare earths, lithium and mineral sands among others) and

non-commodity investments in FY2025 and had a carrying value as

at 30 June 2025 of HK$113,034,000 (As at 30 June 2024:

HK$132,289,000).

Commodity Business

We have an iron ore offtake at Koolan

Island, and we continue to look for new offtake opportunities

across a range of commodities. For FY2025, our Commodity

Business generated a segment loss of HK$8,046,000 (FY2024:

Profit of HK$84,031,000) as a result of weak iron ore prices.

Principal Investment and Financial Services

The Principal Investment and Financial

Services segment, which covers the income generated from loan

receivables and other financial assets. For FY2025, this segment

recognized a profit of HK$7,172,000 (FY2024: HK$38,531,000).

Money Lending

Business Model and Customer Profile

The Group provides both secured and unsecured term loans to its

customers under its Principal Investment and Financial Services

segment. Money lending activities diversifies the income stream

and business risks of the Group, and generates a stable return

with the Group’s available financial resources on hand from time

to time. The Group mainly financed its money lending business by

its internal resources.

The Group does not set a specific target for the industry,

business or level of annual revenue to corporate borrowers. The

customers of the Group’s lending business were referred to the

Group through its corporate or business networks. For FY2025,

customers of the Group’s lending business included Hong Kong

listed companies for secured and unsecured loans.

Outstanding loan receivables net of loss allowances as at 30

June 2025 amounted to approximately HK$83,578,000 (As at 30 June

2024: HK$88,563,000). During the year, the Group has provided

for impairment losses on its loan receivables of approximately

HK$4,267,000 (FY2024: Impairment losses written back of

HK$24,086,000). Details of each of the loans outstanding as at

30 June 2025 are disclosed in note 20 to the consolidated

financial statements.

Risk Management Policies

The Group adopts a thorough credit assessment and approval

process, and will assess and approve each loan transaction on a

case-by-case basis. The finance department of the Group (the

“Finance Department”) is responsible for conducting a background

check on the prospective borrower in compliance with the

applicable laws and regulations, reviewing the background and

financial strength of such borrower and where applicable, the

guarantor, and enquiring the prospective borrower about the

purpose of the loan and the expected source of funds for loan

repayment. To support its analysis, the Group will obtain

corporate documents, financial statements and search reports of

the borrower and/or the guarantor, and thereafter, assess the

credit risk of the loan and negotiate the terms thereof after

considering (i) the background and financial position of the

borrower or the guarantor (if applicable), including net asset

value and gearing ratio; and (ii) the value of the securities,

if any.

Each loan transaction will be approved by either the Board, or

if the loan principal does not exceed the threshold set by the

Board, by the executive committee of the Board.

The Finance Department monitors the loan and interest repayment

regularly and reviews the annual financial statements of the

borrowers and guarantors (if applicable). It would promptly

report to the chief executive or chief financial officer of the

Group for any delay or default in repayment upon maturity, who

would then formulate plans for loan collection, including but

not limited to requesting for additional securities or

initiating legal actions.

Loan Impairment Policies

The Company adopts expected credit loss allowances (“ECLs”)

according to the requirements of Hong Kong Financial Reporting

Standard 9 issued by the Hong Kong Institute of Certified Public

Accountants. Accordingly, it shall review the recoverable amount

of each loan at the end of each reporting period to ensure that

adequate impairment losses are made. The Group applies a general

approach on loan receivables to assess for the ECLs.

Assessment is done based on the Group’s historical credit loss

experience, adjusted for factors that are specific to the

borrower. In order to measure the ECLs of loan receivables, the

Group will apply a credit rating for each of its borrowers by

reference to each borrower’s past default records, current past

due exposure, an analysis of its current financial position,

likelihood or risk of a default, an assessment on any

significant increase in credit risk, and fair value of

collaterals (if any), and adjust for forward looking information

that is available without undue cost or effort, such as the

current and forecasted global economy and the general economic

conditions of the industry in which the borrower operates.

The Group regularly monitors the effectiveness of the criteria

used to identify whether there has been a significant increase

in credit risk and revises them as appropriate to ensure that

the criteria are capable of identifying any significant increase

in credit risk before the loan amount becomes past due.

Forward Looking Observations

A complex global economic outlook in FY2026

is anticipated, with fluctuations in US trade policies,

intensifying geopolitical tensions and decelerating global

growth. While the US economy has shown resilience, there is

still uncertainty on the effect of US tariffs on inflation and

demand, leading to difficulties in an interest rate cut

decision. Meanwhile, the structural challenges of China persist

without large scale stimulus, particularly in the property

sector, with prices continue to fall this year, and China

Producer Prices have deflated for 34-months, which contribute to

subdued domestic demand. We believe that precious metals

investment demand will continue to be strong, amid uncertainty

around global economy and rising US debt levels. At the same

time, we see opportunities in select commodities that are

long-term beneficiaries of secular trends such as energy

transition and increasing AI activity. We remain selective with

our investments in the near term and continue to look for

high-quality opportunities that will generate attractive returns

over the long run. Our mining and energy investment portfolios

are the platform for future mining and energy investments. Our

largest investment is in Mount Gibson, which has successfully

ramped up production at the Koolan Island mine and is now

generating significant free cash flow over the remaining two

years of mine life. On 16 July 2025, Mount Gibson has announced

reaching agreement to acquire 50% of the CTPJV plus adjacent

wholly owned exploration tenements from Northern Star. The

acquisition provides Mount Gibson with an opportunity to

leverage the success of its Koolan Island iron ore operation to

establish the foundations of a gold production business.

|